- 28 Feb, 2024

How to Utilize a VA Loan for Zero Down Payment to Purchase a Multi-Family Fourplex

Multi-Family Fourplex loan with no down payment for veteran homebuyers

Ever dreamt of being both a homeowner and an investor simultaneously? Utilizing the VA Loan could be the ticket to achieve your goal.

Buying a multi-family fourplex with a VA Loan program is a great way for veterans to purchase a rental property that will provide income while allowing them to build equity.

Understanding VA Loans

A VA loan is a mortgage program designed to assist veterans, active-duty service members, and eligible surviving spouses in purchasing homes with favorable terms. Administered by the U.S. Department of Veterans Affairs, VA loans offer benefits such as no down payment requirement, competitive interest rates, and limited closing costs.

These loans do not require private mortgage insurance (PMI), making them a cost-effective option for those who have served in the military and their families to achieve homeownership.

5 Types of VA Loans

When it comes to acquiring a home through the VA loan program, veterans, active-duty service members, and qualified surviving spouses have a variety of alternatives. Here is an overview of the multiple kinds of VA loans available.

-

Purchase Loans

This is intended to assist individuals in owning a home with no down payment required. VA purchases loans by providing competitive interest rates and flexible qualification standards.

-

Cash-Out Refinance Loans

Veterans may utilize the equity in their houses to refinance their current mortgage, allowing them access to funds for home improvements, debt consolidation, or other financial needs.

-

Interest Rate Reduction Refinance Loans (IRRRL)

IRRRLs, also known as VA streamlined refinancing, allow veterans to refinance their current VA loan at a lower interest rate, possibly reducing monthly payments and saving money over the life of the loan.

-

Adapted Housing Grants

These funds are specifically designed for disabled veterans and help them remodel or purchase an adapted house to accommodate disabilities sustained while on duty.

-

Native American Direct Loan Program

This program is only for Native American veterans and allows them to buy, develop, or improve homes on federal trust land, guaranteeing access to safe and affordable housing in tribal communities.

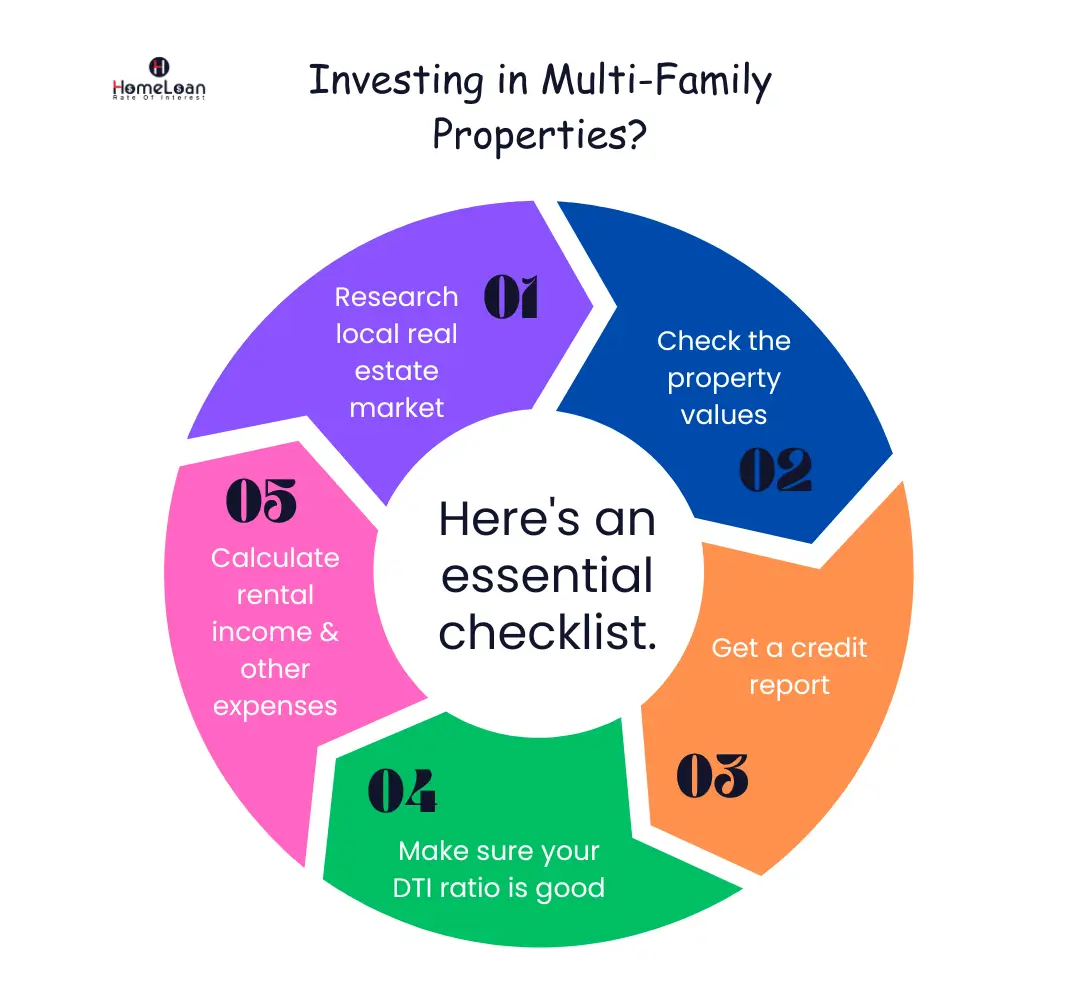

Factors to Consider Before Investing in a Multi-Family Property

Investing in a multi-family property needs keen consideration and planning. Here are the factors one should keep in mind before diving into the process.

-

Market Analysis

Check out the local real estate market and get to know about the trends, rental demand, and property values in the area where you plan to invest.

-

Financially prepared

Have a look at your financial status including your credit score, debt-to-income ratio (DTI), and savings, Then ensure that your income fits your mortgage payment and property expenses.

-

Managing Property

See whether you can manage the property by yourself or should get assistance from the property management company. That is, maintaining a multi-family property requires lots of time, extra effort, and expertise in tenant relations and management.

-

Analyzing cash flow

Calculate the rental income and expenses associated with the property, including mortgage payments, property taxes, insurance, maintenance costs, and vacancies.

Finding the Right Multi-Family Fourplex

Once you've decided on your investment preparation, the next step is to discover the ideal multi-family fourplex for your needs. Consider the following factors all over your search -

-

Firstly check out the location, properties, and neighborhoods with low vacancy and higher rental demand.

-

Then look into the property thoroughly to assess its condition and identify any potential repairs or renovations needed.

-

Elevate the rental income potential of each unit within the fourplex, and watch out the factors like unit size, amenities, and comparable rental rates in the areas.

-

Last but not least analyze whether the property fits self-management or needs any professional assistance.

7 Steps to Apply for a VA Loan

Once you've found a suitable multi-family fourplex, before diving into the purchasing process it is essential to pre-qualify for a VA loan for that this step-by-step guide will walk you through the process smoothly.

Step 1- Check your Eligibility

Before applying for a VA loan, check that you are ready with the eligibility requirements. Generally, veterans, active duty service members, National Guard members, and certain spouses may qualify for a VA loan. Get ready with your Certificate of Eligibility (COE) to prove the lenders.

Step 2 - Search a VA- Approved Lender

Look out for a lender who got approved to originate VA loans, research multiple lenders, and compare the quotes, interest rates, fees, and testimonials to choose the best that fits you.

Step 3 - Gather Required Documents

Get ready with the necessary documents for the application process including -

Proof of military service or eligibility

Personal identification (e.g., driver's license, Social Security number)

Employment and income verification (pay stubs, W-2 forms, tax returns)

Bank statements and other financial documents

Step 4- Finish Off Loan Application

After choosing the perfect lender, fill out the VA loan application form provided by the lender. Prepare all the detailed info about the financial status, employment history, and property you fixed to purchase.

Step 5- Await Underwriting & Approval

After submitting and pre-approval of the application the lender will review the documents and verify the eligibility for a VA loan, This involves underwriting where they assess your creditworthiness and the property value.

Step 6- Get the VA Appraisal

As part of the process, a VA-approved appraiser will assess the property's value and ensure that it meets the VA standards and is worth the loan amount.

Step 7 - Close the loan and move in

Once the loan is approved then you can schedule the closing date with the lender and the seller. While closing one has to sign the necessary paperwork are mortgage note and closing disclosure.

Utilizing Zero Down Payment Options

The most attractive feature of the VA loan is the ability to buy a home with a Zero down payment, Here is how you get benefits for a multi-family fourplex

-

VA Loan assistance program will help to cover up the upfront costs connected with purchasing the property.

-

One more add-on benefit is negotiation with the sellers to close or offer concessions to offset expenses typically paid by the buyers.

Closing the deal

Once your VA loan is approved you can be ready to acquire your multi-family fourplex. After signing the various documents, be sure to review all the documents carefully. If you are unsure about the terms and conditions just shoot up the question and clarify it, once complete you'll receive the key to your new investment property.

Managing and Maintaining the Investment

After acquiring your multi-family fourplex, It is essential for you to effectively manage and maintain for long-term success. Follow these tips -

-

Tenant owner relation

Be clear in communication with your tenant and address their problems, needs, and concerns promptly.

-

Routine Maintenance

Go for a regular maintenance schedule to do the repairs and keep it up properly including the common areas and individual units.

-

Finance managing

Make a note of detailed records about the rental income and expenses to track the cash flow and monitor the property's financial status.

-

Emergency Funds

Maintain an emergency fund that covers unexpected expenses such as repairs, renovations and vacancies.

Bottom line

In wrapping up our discussion on utilizing a VA loan for a zero down payment on a multi-family fourplex, you might be wondering: Is this truly the best option for me? Absolutely!

For veterans and active-duty service members, a VA loan offers unbeatable benefits, from no down payment to competitive interest rates. So you can secure a property with minimal upfront costs while setting the stage for long-term financial growth through rental income.

So, if you're ready to take the plunge into real estate investment, let your VA loan pave the way to homeownership and prosperity.

Racheli Refael

- Mortgage Advisor

Racheli, backed by over 28 years of experience, the go-to mortgage pro for home buyers seeking pre-approvals. Alongside her expertise in Divorce Mortgage Planning, she offers real estate agents best-in-class support in ensuring seamless transactions for both buyers and sellers.