- 08 Nov, 2023

Is it smart to use a home equity loan to invest in Texas?

All-in-one guide to home equity loans in Texas

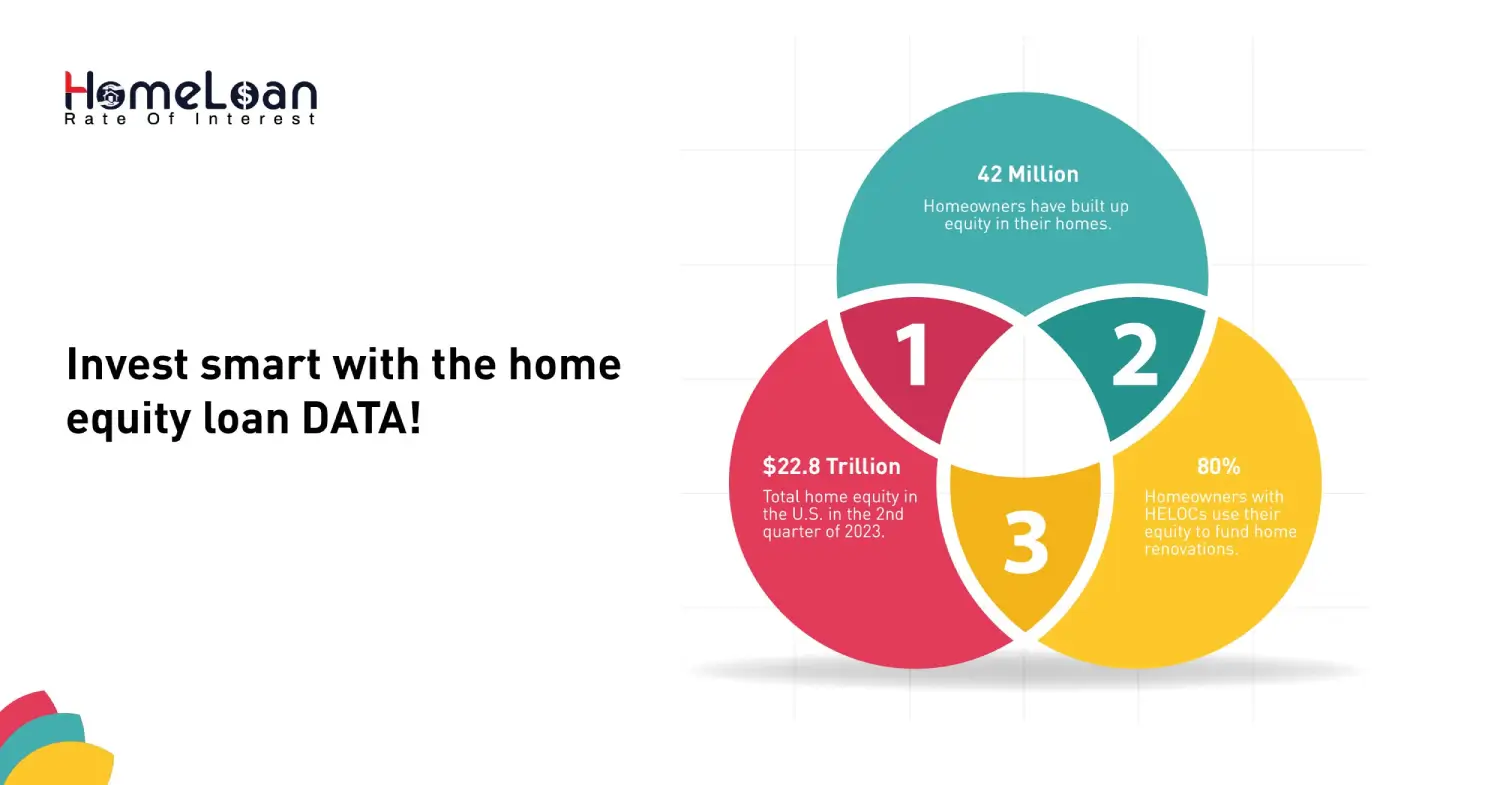

Texas is a great place that offers a variety of investment opportunities for its residents. With the rise in demand for housing properties, the market value of every property in Texas has also gone up.

However, many homeowners seek alternative options to tap into their home equity and invest in Texas home improvements, consolidating higher interest debts, or meeting emergency medical expenses.

In this blog, we will learn if it is smart to use a home equity loan to invest in Texas by analyzing the benefits of home equity fixed loan rates.

Understand home equity loans Texas in less than 2 MINS

This particular loan type is especially for homeowners as it enables them to take out a loan based on the equity they have built in their homes.

-

Equity is the difference between the current market value of the home and the outstanding balance in the mortgage.

-

Without a property in place, it is not possible to secure a home equity loan. This means that the home serves as collateral for the loan and is secured.

-

If the borrower defaults on the loan, the lender will have the legal authority to claim the property.

-

With the approval of a home equity loan, homeowners will receive a lump sum of cash in a single disbursement to use for their home improvement needs or debt consolidation.

-

However, the amount of loan that is granted to a borrower differs and it depends on the type of property they own, the place where it’s located, and the outstanding mortgage balance left.

On the whole, homeowners will have versatility in how they use the funds obtained through a home equity loan. Home equity loans in Texas can be a valuable and secure financial tool for borrowers and lenders compared to unsecured loans.

Importance of financial self-assessment

Before understanding the use of home equity loans for investment in the Texan market, it is important to conduct a comprehensive self-assessment to understand how much home equity will be needed by evaluating your goals and determining risk tolerance.

Home equity loans in Texas have certain eligibility requirements and credit score criteria to be met. In addition to that the rate of interest also differs. So as a resident of Texas, here’s why it is important to conduct a self-assessment:

-

Get clarity on your financial needs

A self-assessment helps in providing clarity on your current financial situation. Analyzing your finances gives you a clear direction for your future investment opportunities.

-

Risk mitigation

Aligning your financial goals during a self-assessment will help you to identify potential risks and take steps to mitigate them.

Whether your goal is to renovate your home, pay immediate medical bills, settle higher-interest loans, or fund expensive tuition fees, knowing how much you need out of your home equity will help you reduce the risk of overborrowing.

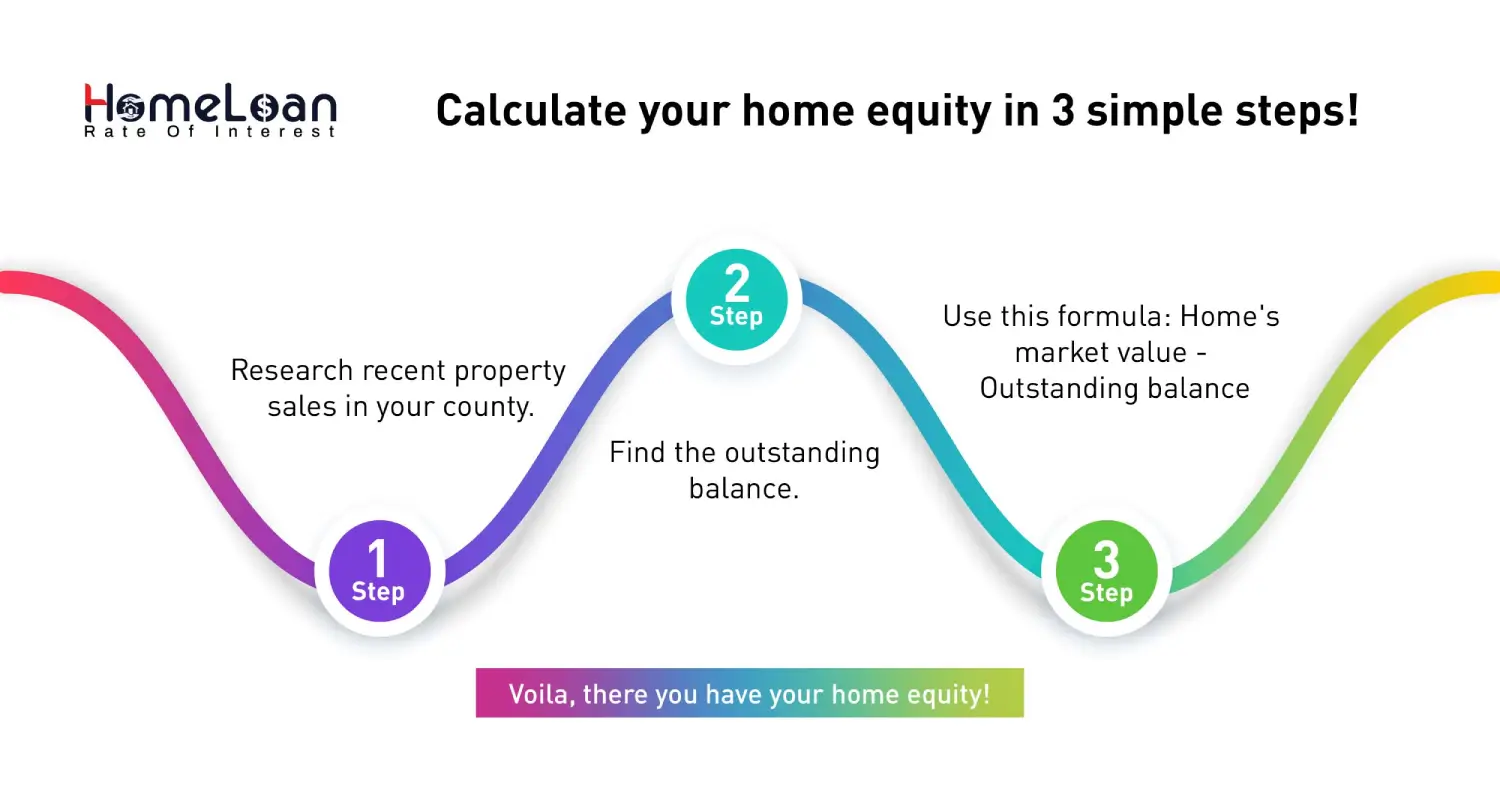

How to calculate your home equity in Texas?

During the assessment of your financial situation, you should know how your equity is calculated so that you can confidently approach the lenders. Here's how to calculate it:

-

Step 1: Evaluate the market value of your home.

Start with estimating the current market value of your home by researching recent property sales in your county of Texas or by consulting with a real estate professional.

-

Step 2: Find your mortgage balance

Go through your mortgage documents where the total mortgage amount and the terms are mentioned.

Compare that with the most recent mortgage statement to determine your outstanding mortgage balance.

-

Step 3: Calculate your home equity

Once you arrive at your outstanding mortgage balance, it is time to calculate your home equity. The calculation formula goes like this - subtract your mortgage balance from your home's market value. The result is your home equity.

For example, if your home’s market value is $450,000, and you owe $200,000 on your outstanding mortgage balance, your home equity is $250,000.

Now, remember that these figures are not the exact estimate of your home equity. The actual calculation processed by every lender is different and is done only after a proper appraisal process.

This calculation of your home equity is just to get an idea of how much equity you have accumulated over the years of homeownership.

If you want an accurate calculation of home equity, get the perfect figures using our calculator here.

Home equity loan investment opportunities in Texas

Texas provides a number of investment opportunities for all individuals who want to make good use of their home equity.

However, property values in cities like Austin, Houston, and Dallas have steadily risen, and this makes a home equity loan an enticing option for those seeking investment opportunities in Texas.

Let’s see the available investment opportunities in the Texan home equity loan market:

Investment in real estate

This is one of the go-to options for Texans to use their home equity loans. Whether you want to purchase additional rental properties or invest in commercial real estate, the opportunities are vast.

Real estate could be one of your investment touch points if you’d like to take out a home equity loan.

Home Improvements

A wise way to use home equity loans in Texas is to reinvest in your current property. Home renovations and improvements can improve the quality of your living space but can also upgrade the overall value of your home.

This home appreciation can result in a substantial return on investment when you decide to resell the property.

-

Debt Consolidation

Another way to use a home equity loan effectively is to consolidate high-interest debts, such as credit card debt or personal loans.

Paying off these debts with a lower-interest home equity loan can free up more of your income for other investment opportunities.

-

Education and Business Ventures

Many individuals who want to kick-start their careers by getting a quality education or venturing into passionate business opportunities can use home equity loans to the highest potential.

Texas is home to one of the top renowned universities and a thriving entrepreneurial ecosystem, making it an attractive destination for those seeking growth in these areas.

Can you use a home equity loan for investment in Texas?

There are certain laws that you need to be aware of while taking out home equity loans for investment purposes in Texas. These applicable laws help you do better planning & determine the exact time to utilize the investment property.

-

Only 80% of the property's equity can be accessed for the purpose of investment. If the total value of your asset amounts to $400,000 and your outstanding mortgage is zero, you can borrow up to $320,000.

If you still owe an outstanding balance of $20,000, the maximum amount that you're allowed to borrow would be $300,000.

-

Borrowing multiple home equity loans will drain your pockets and mental health. If you'd like to do so, make sure to pay off the existing one first.

If you're confused about planning a home equity loan for an investment, we can assist you with your strategy. We believe in making the home equity loan process as simple as possible. So, explore and apply today!

-

Remember that you can only apply for one home equity loan within a 12-month period. This means that even if you have paid off your primary home equity loan, you will not be able to apply for another home equity loan in 12 months.

-

The home equity loan approval for investment purposes typically takes around a minimum of 30 days and one cannot expect it to be closed within 2 weeks of application.

Why should you know about the 2% Rule in Texas?

This is applicable for home equity loans taken for the purpose of investment where the lenders charge you a maximum of 2% of the loan amount as fees. Remember to check if these fees don't include survey, appraisal, or title fees.

Your lenders are required to provide you with a statement of all the fees and charges on the loan. You need to check these before closing as this is a requirement for you as a borrower.

How can home equity fixed loan rates benefit the borrowers?

When you opt for home equity fixed loan rates, your interest rate remains constant throughout the life of the loan, providing predictability and stability in your monthly payments.

This helps you plan and budget better for your financial future, and moreover, the stability can be particularly valuable if you have a fixed income or prefer knowing exactly what your expenses will be each month.

No.1 - Predictable monthly payments

One of the primary advantages of a home equity fixed loan rate is that it is predictable in nature. Every borrower knows that his/her interest rates don’t change irrespective of market fluctuations.

With a fixed rate of interest, you can manage monthly mortgage payments as they remain the same.

No.2 - Safeguard from interest rate fluctuations

Unlike variable-rate loans, home equity fixed loan rates shield you from interest rate fluctuations in the market.

Even if the market interest rates rise, your loan's interest rate remains unchanged. Ultimately, this protection can provide peace of mind and financial security, as you need to worry about sudden increases in your interest payments.

No.3 - Long-Term Planning

Home equity fixed loan rates are usually preferred to do long-term financial planning and help you strategize your repayment methods over an extended period.

Whether you're using equity to fund your home improvement projects, investing in education, or consolidating debt, fixed-rate loans will pave the way for a planned and structured repayment process.

If you’re new to Texas or investing, home equity loans can provide you with enough funds for investment opportunities.

It comes with potential benefits, such as low-interest rates and quick access to funds. But, it also comes with certain risk factors, if the amount of equity in your home is lesser than your required borrowing amount.

To determine if it's the right choice for you, conduct a thorough self-assessment, explore investment opportunities in Texas, and consider meeting with a mortgage professional.