- 22 Nov, 2023

The top 10 dos and don'ts to successfully qualify for a conventional loan

How do you meet all the conventional loan requirements?

If achieving the goal of homeownership is one of your resolutions for 2024, then a conventional loan is an option worth exploring. But, checking all the boxes to meet the conventional loan requirements is no walk in the park.

Where there’s a will, there’s a way! So, if you’re determined to achieve your homeownership, you will definitely find the ways to achieve it. In this blog, we will go through the top 10 dos and don'ts to successfully qualify for a conventional loan.

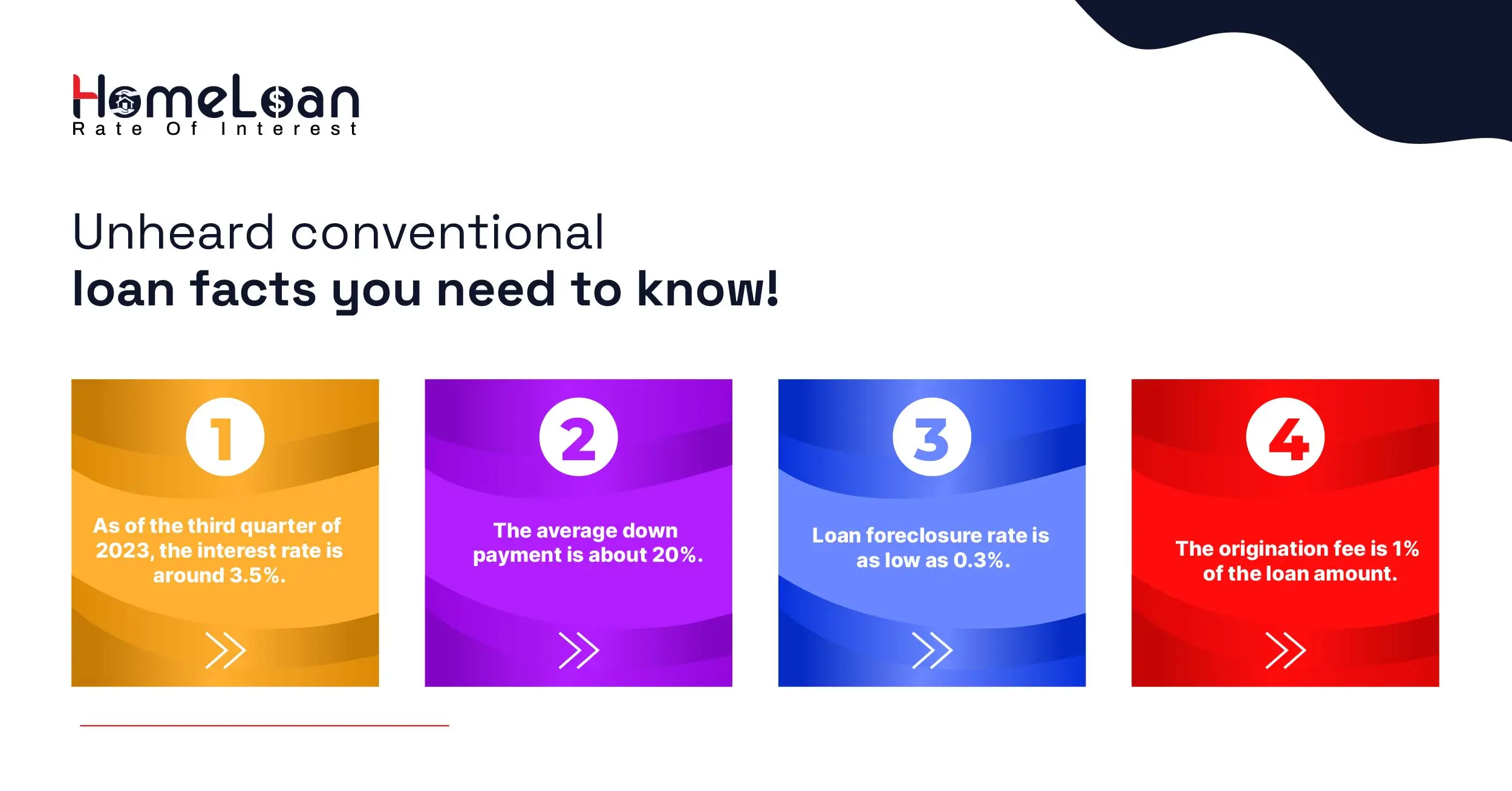

Understanding conventional loan requirements

Conventional loans are offered by private lenders and are not backed by the government, unlike Federal Housing Administration (FHA) loans. Conventional loans have a fixed rate of interest.

They are considered to be a popular choice for homebuyers with a stable financial background. The loans offered by private lenders are offered based on the financial stability of the borrowers. There are no such rules for conventional mortgage loans, but here are some of the basic qualifications for conventional loans:

-

A minimum credit score of 620, based on the loan amount.

-

Maintain a debt-to-income ratio under 43%.

-

Pay an upfront down payment of 3%.

-

The total loan amount is $510,400 or less.

-

No history of credit issues like foreclosure or bankruptcy.

In addition to the above, lenders also prefer borrowers to have a reliable source of income through consistent employment history. We will discuss more about getting approved for conventional loans in the coming sections.

What is a conventional loan limit?

Conventional loan limits refer to the maximum loan amount that lenders are willing to underwrite based on the borrower’s financial portfolio.

-

These limits vary by location and are influenced by factors such as local property values and housing market conditions.

-

The conventional mortgage loan limits are not the same for every county in the U.S., as housing market prices are set based on competing and prevailing economic conditions.

-

Exceeding 2023 conforming loan limits will further complicate the loan approval process and delay homeownership. In case the desired loan amount surpasses the loan limits, there are alternative loan options to explore.

Strategies to stick within conventional loan limits

When you understand the limits of conventional loans and want to enhance your chances of qualifying for a loan, implement these strategic approaches for a seamless approval process:

Research the local conventional loan limits

-

While you start your mortgage application process, conduct thorough research on the specific loan limits in your target area.

-

As the conforming loan amounts vary by county and are influenced by local property values, knowing these limits will help you set realistic expectations and guide your home search.

-

Fix your house-hunting criteria

-

There are a ton of filtering options available both online and offline during the house-hunting process. Once you know the max conventional loan limits in your area, you can adjust your home search accordingly.

-

Focus on properties within the price range that aligns with the established loan limits. This ensures that you're considering homes that fall within the scope of the conforming loan limit.

-

Check with your lender

-

Your lender can be a valuable resource in understanding mortgage loan limits. They offer helpful insights into potential solutions and assistance on how to structure your loan application to align with the established limits.

-

If you want timely guidance in planning your mortgage application, schedule a consultation with our mortgage specialists to discuss your financial situation and the specific property you're interested in.

-

Plan for uncertainties

-

No matter how much you try to stick to the county loan limit, there will still be certain external factors such as unexpected market fluctuations or changes in personal financial situations.

-

These factors will help you plan your home buying budget and adapt to evolving circumstances by increasing the chances of a successful approval.

-

Pay a higher down payment

-

If the value of the property you’re looking for crosses the max conforming loan amount, consider making a larger down payment if you can or have the means to.

-

A substantial down payment not only reduces the borrowing loan amount but also showcases your financial stability to lenders.

-

This can make your application stand out and more appealing, even if the property value surpasses the standard limit.

-

Consider government-backed loans

-

When you have tried out all the options and if meeting your conventional loan limits is still challenging, explore government-backed loan options such as FHA or VA loans.

-

These programs usually have flexible criteria, allowing you to qualify for your desirable loan amount. However, keep in mind that these loans come with their own set of requirements.

-

How do conventional loan requirements work?

Getting a conventional loan requires patience. Since the subprime mortgage meltdown in 2007, lenders have become quite stringent in their conventional loan requirements.

-

Yes, there is a lot of paperwork involved but when you provide correct information, getting a conventional loan is relatively easy compared to other loan types.

-

You gather relevant financial information and provide it to the loan officer to complete the mortgage application. Once your loan officer approves the application, you get your loan.

-

All the lenders must supply a list of necessary documents to perform a detailed background check, credit history, and current financial stability of the borrowers.

-

The option of choosing a lender lies in your hands. Most of the private lenders, check if your monthly mortgage payment doesn’t exceed 28% of your gross income.

-

They also cross-check your ability to handle the down payments, along with other costs such as broker fees and underwriting fees.

Documents required for a conventional loan

It is essential that you ask for a list of required documents to submit as it differs based on the borrower’s personal financial situation. Here are some of the basic document requirements:

-

Your official photo identification or driver’s license.

-

Copy of tax return documents for the past two years.

-

Last month’s pay slips (if you’re a W2 employee).

-

Document of proof of funds used to pay for down payment.

-

Statement of assets and liabilities.

-

Copy of credit report ordered by lender.

-

Property appraisal documents if used as collateral.

Top 10 dos and don’ts to qualify for a conventional loan

You are halfway to achieving home ownership if you meet all the above requirements for conventional mortgage. However, there are still certain mistakes that borrowers make while qualifying for a conventional loan.

So, here we have the top 10 dos and don’ts to help you qualify for all the conventional loan requirements:

| Dos | Don’ts |

|---|---|

| 1) Lenders examine your credit scores closely. Make sure to eliminate any errors in your credit score, and improve it to reduce the borrowing costs over the life of the loan. | 1) Major changes to your financial accounts during the application process can trigger red flags. |

| 2) Pay your monthly bills on time to establish a history of responsible financial behavior. | 2) Avoid taking out further credit cards or other forms of loan during the application process. |

| 3) Keep your credit balances below the overall credit limit. Aim to use less than 30% of your available credit. | 3) If you have any thoughts of switching between jobs, don’t do it while the application is in the processing stage. |

| 4) It is good to maintain a DTI ratio below 43%. | 4) Any new additions to your house or new purchases like a new car can also be avoided or postponed. |

| 5) Do pay down existing debts to lower your debt-to-income ratio, which can improve your chances of loan approval and secure a better interest rate. | 5) Avoid managing additional financial commitments by taking up newer debts as it might send the wrong signal to lenders. |

| 6) If you feel like your income is not sufficient to meet monthly mortgage payments, explore opportunities to increase your income, such as side hustles or part-time work. | 6) Don’t start your application without paying off your older debts and credit payments as it will result in over-accumulation of debt. |

| 7) Make a substantial downpayment to demonstrate stability to the lenders. 3% is the minimum requirement, however aiming for 20% can help you get better loan terms. | 7) Don’t miss out on down payment assistance programs available in your area. They are really helpful in funding your down payment amount. |

| 8) Have a stable record of working history. Lenders prefer borrowers with a reliable income source and a consistent work history, reducing perceived risk. | 8) Make sure to get clarification from lenders on any terms and conditions that you don’t understand. This is to avoid any shocks or surprises after approval. |

| 9) Cut down unnecessary expenses and save those funds to pay a good amount required for a down payment. | 9) Don't underestimate the importance of a thorough home inspection and appraisal to ensure the property's value and condition. |

| 10) Do work with a reputable real estate agent and loan officer who can guide you through the home buying and loan application process. | 10) Don't assume that the lender's first offer is the only one available. Negotiate and explore options to secure the best terms for your loan. |

Don’t lose hope if you don’t meet any one of the above conventional loan requirements as most of them can be adjusted and changed if you follow the dos and don’ts to successfully qualify for the conventional loan.

Avoid falling into the trap and false promises of unauthorized mortgage broker’s guidance as it will not help you in any way.

Take the insights from this guide and evaluate your personal financial situation to increase your chances of approval for a conventional loan. Visit our Blog for more detailed information and to further enrich your understanding of conventional loan limits.