- 28 Sep, 2023

Skip the Appraisal and Save: The Benefits of a No Appraisal HELOC

Find out if it’s possible to get a no-appraisal HELOC

Being a homeowner comes with many responsibilities but the advantages are numerous. As an existing homeowner, you might have come across the term HELOC which helps you tap into your equity and use it for various purposes like debt consolidation, home improvements, paying college tuition, or using it as a down payment or to pay long-term care expenses. HELOC can be a great way to access funds quicker than you can ever expect. However, the traditional process of applying for a HELOC and getting funds to use for various purposes is not as easy as it sounds.

In this blog, we will learn about the HELOC’s basics, ways to qualify for a no appraisal heloc, and the importance of credit scores. We will break your curiosity about no appraisal HELOCs and the role they play in achieving your financial goals.

Basics of HELOC

A home equity line of credit is a flexible option to manage finances by borrowing equity against having your home as collateral. Here’s how a HELOC works:

-

It functions as a line of credit where your house is used as collateral for borrowing against your equity.

-

Here, you get to draw funds as you need them up to a predetermined credit limit and pay interest on the amount borrowed.

-

Lenders usually require an appraisal process before approving HELOC.

This evaluation process is something that you need to watch out for, as it takes longer than usual. It is a process of evaluating your property’s current market value that involves professional appraisers and fees.

What is a No Appraisal HELOC?

Before getting into the no appraisal heloc, let us understand the primary objective behind an appraisal. It protects both lenders and borrowers from getting involved in any type of risk. With an appraisal in place, you can tap into the maximum amount of equity to borrow against your house.

If you’re a homeowner who wants to access additional funds to meet your expenses with a HELOC without having to go through a traditional appraisal process, a no appraisal HELOC is something that you need to check out.

2 main benefits of a no appraisal HELOC

-

You don’t have to wait until your property appraisal. Funds can be accessed pretty much faster than usual. If you’re in need of immediate fund requirements, a no appraisal HELOC helps speed up the process.

-

There‘s no need to pay additional appraisal fees. This helps save costs and eliminate unnecessary expenses. These appraisal costs are expensive because they are conducted by licensed professionals and their fee ranges from several hundred to thousands of dollars based on the location and complexity of the appraisal process.

The role of credit scores

Credit scores! The main aspect of every mortgage process. Your credit scores play a fundamental role in determining your eligibility and the loan terms. It is also a significant factor in securing the best interest rates.

Irrespective of the mortgage type, a good credit score helps you secure better loan terms ultimately leading to lowering your interest rates. However, in order to get your HELOC quicker, it is important that you have more than a 583 credit score.

Some lenders might approve your loan with lower credit scores, but the downside is that they will have higher interest rates and unfavorable terms. Therefore, it is advised that you improve your credit scores if they are lower than 583.

Eligibility factors of a no appraisal HELOC

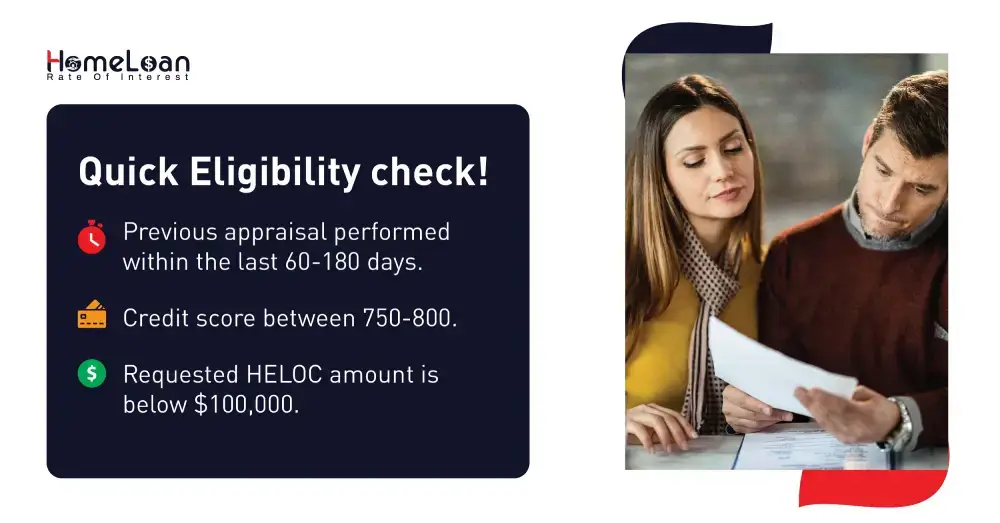

We know the struggle is real! Even after deep research, if you’re still unclear about the eligibility factors and requirements we are here to help you out with a simple no appraisal requirement process. While the application process is easier and quicker in a no appraisal HELOC, it often requires you to have a perfect credit score. So, buckle up and try to improve your credit scores before we get started with understanding the eligibility process.

In order to get your HELOC by skipping the appraisal process, you must meet at least one of these below requirements:

-

Your previous appraisal was just performed between the last 60-180 days.

-

Your credit score is between 750-800

-

Your requested HELOC amount is below $100,000

Yet there are some common eligibility requirements, it is as follows:

-

You need to maintain a minimum equity in your home. Different lenders may have specific guidelines when it comes to minimum equity. Some lenders require you to have 10-20% of equity while you’re applying for a no appraisal heloc.

-

There needs to be proof of stable income to ensure that you will be able to manage the repayment of the line of credit. For this purpose, you might be requested to provide your pay stubs, tax returns, and other proof of income documents.

-

Your debt-to-income ratio will be assessed to determine your ability to manage additional debt. You win if you have a lower DTI ratio.

-

If your financial history demonstrates your responsibility to manage bill and debt payments on time, your chances of getting approval increase.

-

Your eligibility slightly changes based on the type of property you are going to use to secure a HELOC. The eligibility varies depending on investment properties or second homes as no appraisal HELOCs are mostly available for primary residences.

Steps to apply for a no appraisal HELOC

Step 1: Start your journey towards a no appraisal HELOC by researching for lenders. Not all lenders are ready to give a no appraisal heloc. Lenders differ based on the location and it is important that you find those lenders that specialize in or offer this type of financing.

Step 2: This step is all about organization. Yep! You heard us right. Wear the hat of a planner. Gather all your official documents that you think are necessary for a HELOC. Some of the documents you will need are proof of income, credit reports, and your residence information.

Step 3: Get in touch with your lenders personally to inquire about their specific terms and requirements. When you have direct contact with the lenders, it is easier to get your questions answered.

Step 4: After getting your HELOC quotes from lenders, it is time to finalize and get your applications submitted. After this step, your application and provided documents will be reviewed by the lenders. Be prepared to provide additional information during this stage.

Step 5: Once approved, you will have a no appraisal offer in front of you that contains credit limit terms, interest rates, and repayment schedule. Read them thoroughly to sign legal documents and pay any closing costs involved.

Step 6: You did it! Once all the above steps are completed successfully, you will have your funds ready. You can access funds up to the approved credit limit.

Always remember that the lender you choose will impact your HELOC journey, so choose wisely!

A sneak peek into HELOC data!

Here are the Four biggest factors impacting a decision to borrow against equity

-

50% interest rate of the loan

-

40% amount of equity available to borrow against

-

35% performance of financial investments

-

41% job security

How to improve your credit score?

If your credit score is 583 and above, it is possible to get your no appraisal HELOC. But what if your credit score is below 583? What can you do to fix it? We will see all the possible ways to get your credit score up the ladder in this section!

-

To start with, get a review of your credit score. Print out your credit report and look for any errors or inconsistencies.

-

If you have bills to meet, make sure to pay them on time. Consistent and prompt payment of bills can have a positive effect on your credit score. If you’re busy and forget to pay off your bills, make use of technology. Set up reminders on your phone, or fix the auto pay option to avoid late payments.

-

Pay off your existing debt, particularly the ones with higher interest rates and balances. When you clear your outstanding debts quickly, it becomes easier to improve your credit score.

-

While you have a lot of credit and debt payments going on currently, avoid taking up more credit applications when you’re trying to improve your credit score. Always say no to stacking up debts.

-

If you’re still confused about what to do, don’t hesitate to seek professional help. If your credit history is complicated, consult with a financial advisor to solve your credit issues.

It is always possible to improve your credit score. You need to be aware of the ways to get your credit score go up. Read articles online, consult with mortgage professionals, and your friends/family, and learn from their experience and mistakes of what to do and what not to do. This helps you make better decisions regarding your credit score improvement process.

No appraisal HELOC: Drawbacks

While a no appraisal HELOC helps you skip the whole process of appraisal and saves time and costs involved, there are certain drawbacks that you need to be aware of before moving ahead with a no appraisal HELOC.

-

Interest rates

Compared to traditional HELOC, a no appraisal HELOC will have higher interest rates resulting in increasing borrowing costs over time.

-

Variable rate of interest

Many HELOCs including no appraisal HELOCs have variable interest rates, meaning your monthly payments can fluctuate which can make your monthly budgeting a bit challenging.

-

Risk of foreclosure

Accessing your home equity beyond your affordability scale can put you at risk of foreclosure. If the payments are not managed responsibly, you might end up losing your property.

A no appraisal HELOC can be really helpful for those whose credit scores are 583 and lower. Individuals who are in dire need of financial assistance can tap into their home equity quicker than ever by skipping the appraisal process. However, it is essential to understand the flip side of this process as well. Mitigating the risks can help you manage finances and effectively allocate emergency funds for the future.

We advise you to work on your credit scores by exploring all the available financial options and seek professional advice whenever needed. At Home Loan Rate of Interest, we help you get easy access to HELOC by guiding you toward improving your credit score.