- 11 Jan, 2024

5 Cash Out Refinance Strategies in Texas 2024

How to apply for cash-out refinance in Texas?

Are you someone considering a cash out refinance or heard the term and wondering what a cash out refinance is, how they work and what are the benefits of cash out refinance Texas? .

In today’s blog, we are going to dive into all the 5 FHA cash out refinance strategies in Texas 2024.

What is a Texas cash out refinance?

Texas cash out refinance is a mortgage option used by homeowners who want to replace their existing mortgage with a new one , borrowing more than what's owed on their current mortgage. The "cash-out" part means you receive a lump sum of money at closing.

The cash you’re eligible to access entirely depends on the amount of equity available in your home. That being said, let’s move on to grab the 2024 cash out refinance strategies in Texas.

5 cash out refinance strategies in Texas

We will learn more about other cash out refinance options!

But before that, you need to discover the 5 strategies of cash out refinance loans in Texas to know how effectively you can utilize this opportunity – not just to refinance your mortgage but also to maximize the cash in your pocket and receive the funds you need .

-

Maximize your home equity

Home equity in simple terms, is the market value of your home minus what you owe in your mortgage.

So our first strategy involves a close examination of your home's equity. Before getting into the Texas cash out refinance process, take the time to accurately assess the current value of your property.

Consider making enhancements to your home so that you can boost its overall value. This proactive approach ensures that when you apply for the refinance, you're positioned to unlock the maximum amount possible.

-

Understand loan-to-value (LTV) ratios

The LTV ratio is used to compare your mortgage amount with the appraised value of your property. They help lenders assess the risk they have to incur while they lend money to borrowers.

Higher LTV ratios are considered to be risky. It means that, after the loan has been approved, you will have to pay higher interest rates. In addition to that, borrowers will be required to purchase private mortgage insurance to offset their lender’s risk.

How do you calculate your LTV ratio? It’s easy 👇

You divide the amount borrowed by the property’s appraised value. Usually, they are expressed as a percentage. For example - If your home is appraised at $150,000 and you make a down payment of $20,000, the mortgage amount comes down to $130,000.

Your LTV ratio would be $130,000/$150,000 = 86%. In this case, it is considered to be a higher risk and you will be required to purchase private mortgage insurance.

If you look closely, the more amount you pay towards a down payment, the higher chances you have of reducing the LTV ratio.

This strategy not only improves your financial standing but also positions you for a smoother refinancing experience.

-

Understand Texas specific regulations

The Lone Star state, with its distinct charm, also comes with its own set of rules that govern cash-out refinancing.

To ensure a seamless and compliant refinancing process, you need to stay informed about these because cash out refinance Texas rules are different from other States.

Consult with Texas mortgage experts who can add an extra layer of insight, providing valuable guidance so you can successfully get cash out refinance in Texas.

But, the good news is that the rules in Texas are not as strict as they used to be. You can pull out the cash from your home as you maintain a decent credit and have more than 20% home equity.

-

Make use of limited cash out refinance

Here you can replace your existing mortgage with a new one but at a slightly higher loan amount. This is usually preferred by borrowers who want to add their refinancing costs to their newer loan balance instead of paying it themselves.

If you’re going to use limited cash out refinance loans in Texas, the cash back you receive is limited and the amount can’t be higher than 2% of the new loan balance or $2,000. This is followed as per the Fannie Mae limited cash-out refi guidelines.

If you require additional cash, you need to apply for a regular cash out refi in Texas. Visit, Home Loan Rate of Interest to explore the benefits of a regular cash-out refinance and get pre-approved now.

-

Mitigate all the risks

It’s time for you to accept that every financial decision comes with its share of risks and rewards.

Whether it's market fluctuations or unexpected expenses, being aware of these risks can’t be skipped.

Staying updated, helps you develop proactive measures to tackle the risks while maximizing the rewards of accessing your home equity. It's a strategic approach that combines foresight with financial savvy.

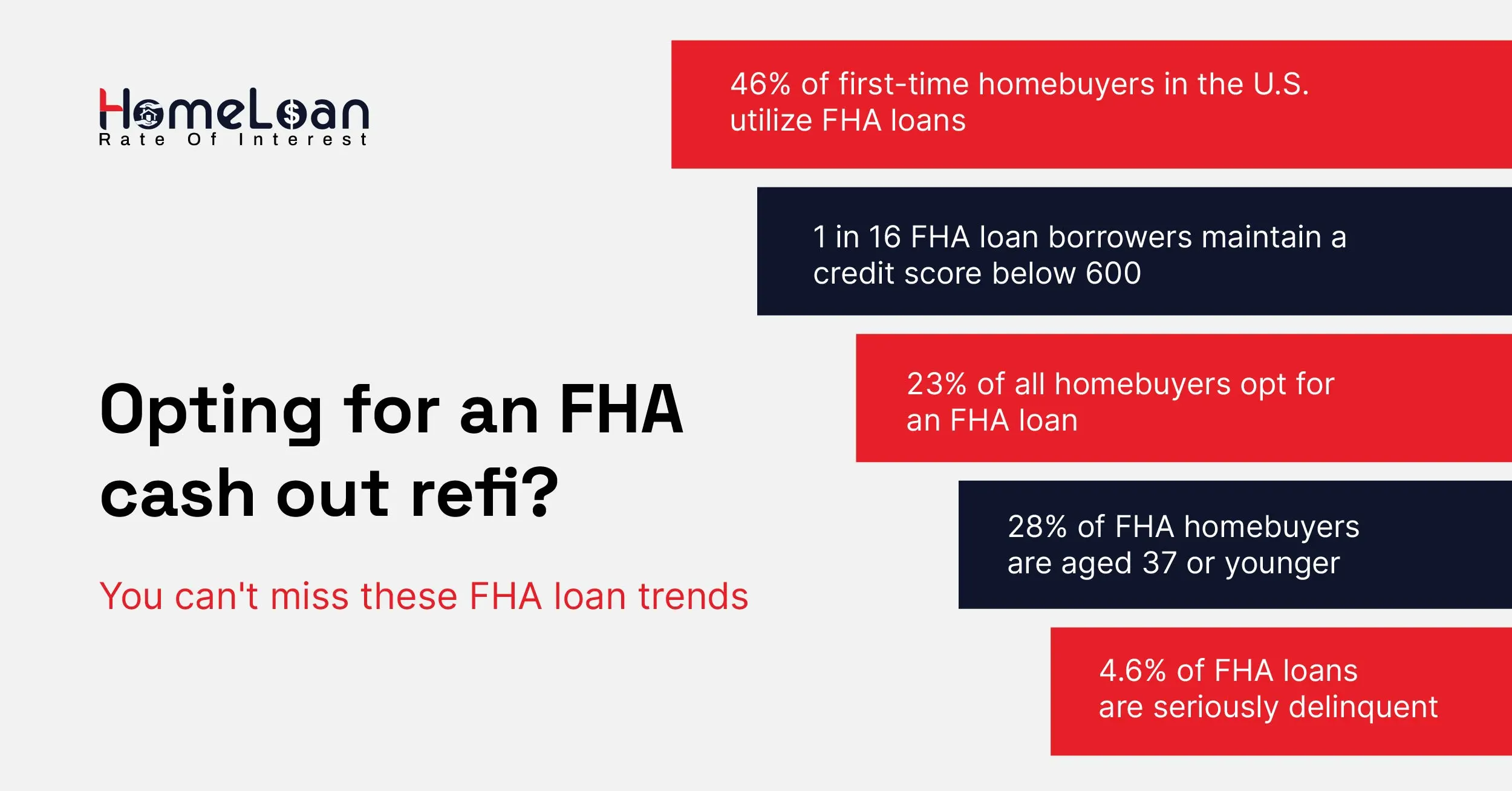

Now that you have all the ready-to-implement strategies, it is time for us to dig deeper into FHA cash out refinance Texas.

FHA cash out refinance vs regular cash out refinance

The main difference between an FHA and regular cash out refinance is that when you opt for an FHA cash out refinance, your mortgage is insured by the Federal Housing Administration.

If you’re looking for lower interest rates and have a lower credit score, FHA cash out refinance is the best option. However, every mortgage has both advantages and disadvantages.

So, FHA cash out refinance requires you to pay mortgage insurance premiums for either 11 years or through the mortgage term based on the borrowed amount.

We know what you’re thinking – Do I need to have an ongoing FHA mortgage to apply for an FHA cash out refinance?

Luckily, no! You can apply for an FHA cash out refi, even if you’re not currently paying off an FHA loan.

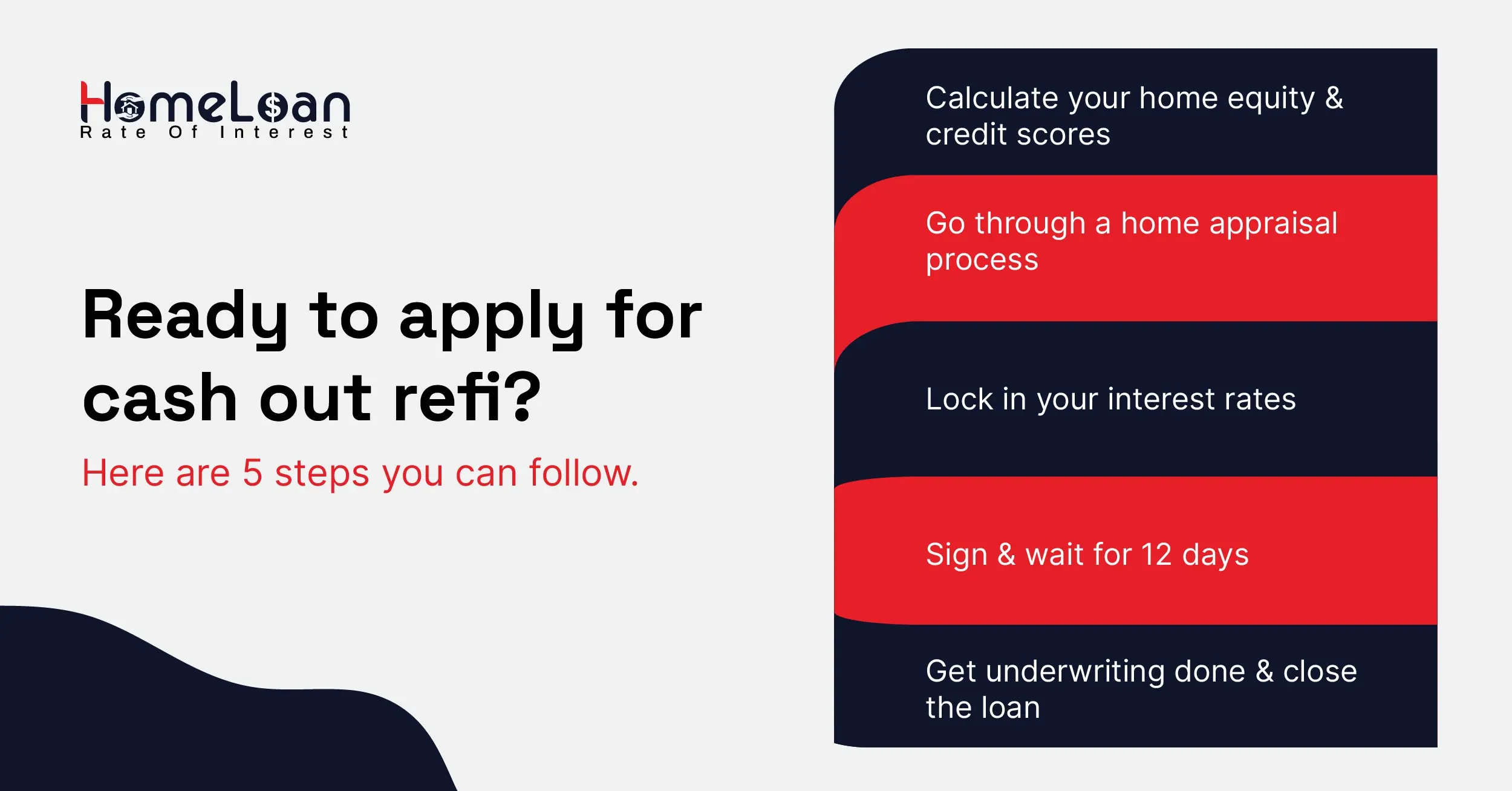

Let’s now have a quick look into the process of applying for cash out refinance in Texas.

Cash out refinance Texas process

While the steps involved can vary from one Texas lender to the next, here’s what you can often expect.

-

Check your credit & equity availability

By default, you need to check your credit score before applying for a mortgage. There are free and low-cost services available online.

If you haven’t done so in the last 12 months, you can also request a free copy from the three major credit reporting agencies. In addition to that, you need enough equity in your home, at least 20% to qualify.

-

Home appraisal

Depending on the lender, you may be required to pay for a home appraisal to confirm the property’s value, which could cost you a few hundred dollars.

Don’t forget to let your lender and the home appraiser know about any repairs or improvements you’ve made to the house since you bought it.

-

Lock your rate

Once you are satisfied with the rates, you might have to lock in the interest rate quote as soon as possible. This protects you during the closing process, which could take up to 45 days to finish.

However, if interest rates go up during that time, you may end up paying a higher rate than necessary. Additionally, some lenders may charge a fee for locking in your interest rate.

-

Sign a 12-day letter

In order to get a cash-out refinance in Texas, homeowners have to sign a letter that explains how the process works.

Even though cash-out loans may take less time to finish, the law requires that there be a 12-day wait period between the application and the loan closing.

-

Go through underwriting & closing

Your loan will proceed to the closing stage once all required documentation and verifications have been completed.

The closing agent will coordinate the signing of final documents, funds disbursement, and recording of the new mortgage with the county recorder’s office. This procedure can take several days to several weeks.

These are some of the important steps every borrower must go through in order to successfully qualify for an FHA cash out refinance in Texas.

Before closing our blog, there’s one more thing you need to know if you’re residing in Texas. It is all about the “rules”.

Don’t worry, we won’t go deep into the legal aspects but it is necessary for you to understand all the rules of cash out refinance in Texas to make sure you are headed in the right direction.

Cash out refinance texas rules

The cash out refinance rules are framed to protect the homeowners and their equity. Knowing them will help you avoid potential penalties and legal complications. Here’s a breakdown of the Texas rules:

-

Closing costs charged by your lender cannot exceed 2% of your loan amount. This is applied to the fees charged by your lender.

-

Your refinanced loan amount can’t exceed 80% of your home’s value. You need to leave 20% of equity untouched when pocketing the cash.

-

All your second mortgages must be paid off. If you already have a home equity loan or HELOC, your new cash-out refi will have to pay off these loans along with your primary mortgage.

-

You need to wait for six months to refinance after initially buying the home. In Texas you’re eligible for a cash-out refinance only when you’ve had your existing mortgage for at least 6 months.

-

After a foreclosure, you need to wait for seven years, four years after bankruptcy, and a short sale before you can qualify for a Texas 50(a)(6) cash-out refinance.

-

In Texas cash-out mortgages aren’t backed by the federal government. So, there’s no FHA cash-out refinance or VA cash-out refinance in Texas.

-

If you already have a Texas cash-out loan in place, you can’t take out a home equity loan or HELOC.

-

Texas cash-out refinance loan rules apply to your primary residence and not to your investment properties and second homes.

The rules are laid down to protect the interests of both you and your lenders. You need not have these rules at the back of your hand, as you can always come back to this blog or reach out to your lenders directly.

We want you to know them so that you don’t fall into any penalties or compliance issues.

Should you consider cash out refinance texas?

If you can secure a favorable interest rate on the new loan, it may be a smart move. Lower interest rates can lead to long-term savings and make the refinance financially beneficial.

However, the purpose of the funds matters significantly. It's generally not advisable to pursue a cash-out refinance for non-appreciating assets like vacations or a new car.

In such cases, you may end up with little to no return on your investment, and the long-term financial benefits may be limited.

But, if you plan to use the funds for a home improvement project, it could be a strategic move. This is because the investment in your home can potentially increase its value, helping to rebuild the equity you're taking out.

Regardless of the purpose, you need to remember that a cash-out refinance involves using your home as collateral.

So, if you plan on taking out a cash out refinance in Texas, plan your monthly payments wisely and make sure you close the loan, so you get to continue your homeownership.