- 20 Dec, 2023

Reverse Mortgage vs. HELOC - Which is Right for You?

Reverse mortgage vs HELOC: How do you choose the right one?

Homeownership is one of your life's best and most expensive decisions. However, owning a home comes with multiple perks. One such perk is to utilize your equity when you’re in need of financial assistance.

But the question is, how do you use this equity with the available options in the mortgage market? Which is better HELOC or reverse mortgage?

By the end of this blog, you will get the answers to all your questions and choose the best loan while assessing your needs and financial goals.

Revisiting the basics of reverse mortgage

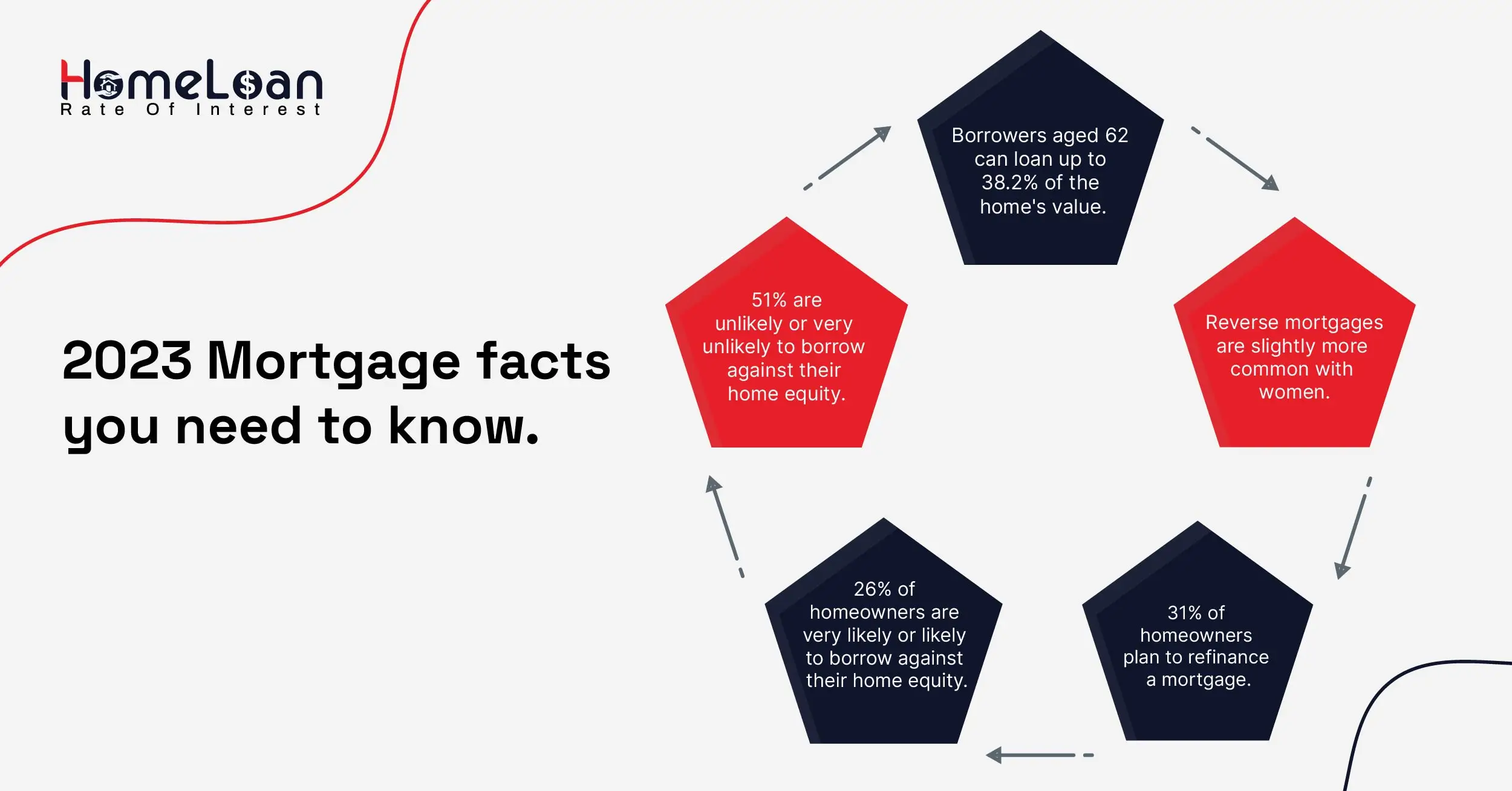

They are one of the most commonly used loan options for older homeowners. The minimum age to qualify is 62 years but you can get started with the process from 55 years of age.

Reverse mortgages are quite different from HELOCs, as they don’t require you to pay interest or monthly payments.

So, how do they work?

In simple words, instead of paying the lender, the lender pays you. Eligibility criteria typically include age (usually 55 or 62 and older), homeownership, and sufficient home equity.

Let’s understand a reverse mortgage better with real-life scenarios!

Real life case study #1 - The Franklins

Meet the Franklins!

A retired couple seeking financial stability. After a detailed analysis and comparison between HELOC vs reverse mortgage, Franklin decided to go for a reverse mortgage at the age of 64.

He has an equity of up to $450,000 with no existing mortgage.

His main goal in choosing a reverse mortgage is to achieve financial stability during retirement.

By using the available equity in his home, he is able to support his wife by accessing regular streams of income without any burden of monthly mortgage payments or extra debts.

It not only helped the Franklins in addressing their day-to-day living expenses but also facilitated them to comfortably manage healthcare expenditures and unforeseen financial obligations.

The Franklins' real-life scenario illustrates how a reverse mortgage can be a strategic financial tool for retirees who are looking to strengthen their financial well-being during their golden years.

It provides them with the means to access the value of their home without sacrificing ownership, offering a tailored solution for financial stability and peace of mind in retirement.

Now that we know Franklin’s brilliant choice, it’s time to make the next choice for you! Let’s get that started by understanding the plus and minuses of a reverse mortgage.

Benefits and drawbacks of reverse mortgage

Making the right decision always feels good, doesn't it? Then, it’s always best to start by considering the pros and cons of reverse mortgage vs HELOC.

We will get to HELOC in a few seconds but this comparison will help you figure out the dos and don'ts while making the right choice.

Let’s get right into it!

| Benefits | Drawbacks |

|---|---|

| 1) Reverse mortgages provide retirees with a valuable source of supplemental income. | 1) The amount that the homeowner owes to the lender goes up and not down. |

| 2) This cash flow can help maintain a comfortable standard of living during retirement. | 2) You need to understand that the reverse mortgage loan is not free money. |

| 3) The good thing is, that borrowers don’t have to pay the monthly mortgage payments, making it easier to manage other expenses. | 3) Your loan balance increases as the interest and fees are added to the available balance. |

| 4) Borrowers can still retain their homeownership, and continue to live in their property while using the reverse mortgage funds. | 4) This can lead to a reduction in the equity remaining in the home over the years, impacting the inheritance left to heirs. |

| 5) There is no restriction on how the borrowers need to use their funds as they’re tailored as per individual preferences. | 5) Sometimes, changes in the housing market can affect your home’s value and if homeowners prefer to keep their property, a reverse mortgage may not be an ideal option. |

Now that we have the foundations of a reverse mortgage set right, let’s jump into the concept of a Home equity line of credit and come up with a perfect HELOC strategy for you.

Breaking down HELOC

As we compare HELOC vs reverse mortgage, HELOC works more like a credit card and it lets the homeowners borrow money from the equity in their home when they need funds up to a certain specified amount.

There are typically 2 phases in HELOC. The draw period and the repayment period. During the phase of the draw period, you can borrow money and make interest only payments. This period lasts up to 5 to 10 years.

Once you enter phase 2 which is the repayment period, you will be required to pay all the borrowed money. You will be paying both interest and principal during a set term, which can last up to 20 years.

If you decide to start the repayment before the end of the draw period, you might face some repayment penalty charges. If the total HELOC balance is at zero, the account will be closed automatically.

Remember that the interest rates on your HELOC might vary leading to a fluctuation in your interest payments. If there’s an increase, you might pay higher monthly payments than usual.

Real life case study #2 - Lisa’s HELOC journey

Let’s get into the HELOC Storytime!

Meet Lisa, a homeowner in her mid-40s residing in a suburban neighborhood. Lisa wanted to undertake home renovations, but she didn’t have adequate funds to invest in the project.

As Lisa requires a huge upfront investment, she was unable to use funds from her savings as well. With an existing mortgage and a substantial amount of equity in her property, Lisa saw HELOC as an attractive option to access funds.

She began to start her process by conducting a thorough assessment of her financial situation. She evaluated her credit score, existing mortgage terms, and the current market value of her home.

Satisfied with her financial standing, she approached a lender and submitted her HELOC application, outlining the purpose of the loan and the estimated amount needed for renovations.

Guess what? Her application was approved and she was granted a HELOC with a credit limit based on her home equity.

Here’s what we should learn from Lisa’s successful journey.

She knew what her financial needs were, and she planned accordingly. This helped her understand what she really wanted to make her home renovation process easier.

Not only that, but she had a plan to transition smoothly from the draw period to the repayment period to avoid financial hurdles in the future.

Are you inspired by reading Lisa’s case? You can be the next successful HELOC borrower too! Send in your applications to Home Loan Rate of Interest and get your HELOC approved in not more than 5 minutes.

All you need to do now is evaluate the pros and cons of reverse mortgage vs HELOC and decide what works best for you.

Let’s get into it right away!

Benefits and drawbacks of HELOC

As you know from Lisa’s success story it’s important to look at both sides of the coin. Right from considering the financial goals to assessing the financial situation, it is important to weigh both the risks as well as the rewards before choosing a HELOC.

| Benefits | Drawbacks |

|---|---|

| 1) One of the primary advantages of a HELOC is its readily available. Borrowers can access funds as needed, up to a predetermined credit limit. | 1) Due to the variable interest rates feature, monthly payments might increase and cause a financial strain to the borrower. |

| 2) HELOCs often come with variable interest rates, which can be lower than fixed rates initially. | 2) The flexibility of a HELOC may tempt some borrowers to borrow more than they can comfortably repay. |

| 3) This leads to saving costs in the long run while planning for other expenses efficiently. | 3) Remember, over-borrowing can lead to financial challenges during the repayment period. |

| 4) The exciting news is there is no restriction on the way you use your funds. HELOC funds can be used for various purposes, including home improvements, debt consolidation, education expenses, or emergencies. | 4) Your home acts as collateral in HELOC, and failure to repay can result in foreclosure. It is important to manage your commitments carefully to avoid such situations. |

| 5) If the funds are used to improve the taxpayer’s home, the interest paid on a HELOC may be tax-deductible. | 5) HELOC’s closing fees vary from lender to lender and the location of the property. Don’t forget to include these costs in your calculations. |

Comparing the pros and cons of reverse mortgage vs heloc will help you make better decisions and understand what works best for you. So, make sure to check the upsides and downsides of a reverse mortgage as well as a HELOC.

Now, it’s time to get working on a perfect HELOC strategy for you. Let’s see if you have everything you need to get started.

3 ways to come up with an ultimate HELOC strategy

What is the HELOC strategy? Is this what you’re thinking? If yes, then here’s your answer.

In simple terms, a HELOC strategy is all about efficiently putting your funds towards home improvements, debt repayment, or creating an emergency fund.

Once you’re out of the debate of reverse mortgage vs heloc, and made up your mind to go for a HELOC, consider implementing these strategies for a successful application like Lisa's.

-

Repay your debts with a plan

If you would like to reduce overall interest payments and enhance your credit score to showcase creditworthiness, consider evaluating your debt portfolio and use HELOC funds to pay off high-interest debts.

-

Create an emergency backup

Use your HELOC as a backup emergency fund, ensuring quick access to funds for unexpected expenses.

Immediate access to financial resources without the need for immediate repayment helps you prepare for unforeseen events.

-

Improve your home’s value

Make a list of renovations to be done in your home and invest in your property. This will not only help you upgrade your home but also increase the value of your home.

Consider getting in touch with a home improvement service provider to understand which part of your home needs fixing.

Decision time: Finding the right fit!

If you’re still battling with this question - which is better: heloc or reverse mortgage?

Here’s your answer!

Developing a perfect reverse mortgage and HELOC strategy involves aligning financial goals with tailored approaches. Reverse mortgage is not available for all borrowers but HELOC is available for all. There is no one solution for younger individuals or senior citizens. What’s right for you depends on your financial situation and personal circumstances.

Consulting with financial advisors can provide personalized insights and guidance. By adopting one or a combination of these proven strategies, homeowners can choose what’s best for them while minimizing potential risks.