- 13 Dec, 2023

Can I use a VA Loan for my second home?

Follow just 3 ways to get a VA loan for second home

When thinking of owning a second home in Texas, it is usually imagined as lounging in and chilling away on their weekends.

However, purchasing a second home can really be a financial challenge to many. But, what if we told you that your dream could become a reality with the help of a VA loan?

Yes, it is possible. You can use a VA loan for a second home. But, there are certain requirements that you need to follow and today we will run through all the ins and outs of buying a second home with a VA loan in Texas.

Who is eligible for VA loans and its benefits?

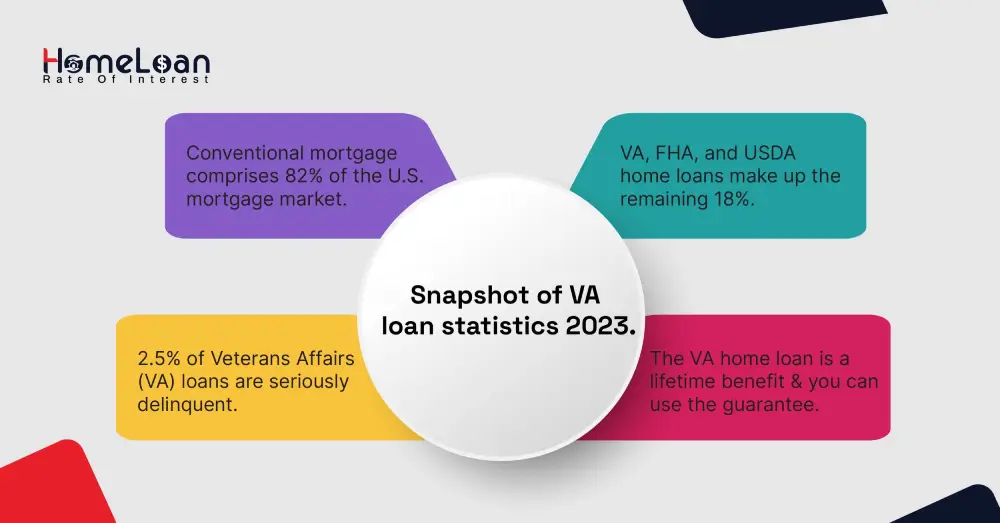

VA loans are known as veteran loans and they are backed by the U.S. Department of Veterans Affairs. They are specifically designed for veterans who want to achieve homeownership.

They come with attractive benefits, such as low-interest rates, no down payment requirements, and more lenient credit score standards.

The reason why lenders offer no down payment loans is because the VA offers specific guarantees to private lenders who offer VA loans.

It is because of these guarantees that private lenders have less stringent requirements to qualify for a VA loan.

So, if you’re a current service member or a surviving spouse of a veteran, going for a VA loan is much better than conventional loan options.

How can you use a VA loan for a second home?

VA loans present an exciting opportunity if you’re looking to expand your real estate portfolio. However, in the lending industry, the actual meaning of a second home is a vacation home that helps homeowners escape the everyday routine.

The primary use of a VA loan is to help veterans buy a primary residence or refinance the terms of their mortgage. But here’s the catch, you technically cannot buy a second home with a VA loan.

What you can do is buy a second primary residence by following the VA loan occupancy requirements.

Let’s understand 3 scenarios of using a VA loan to buy a second home!

-

Scenario #1 - In the case of a fully paid-off first home

➙ In this case, if you’ve already settled your VA loan and want to retain the property originally supported by the VA, it’s essential that you understand your eligibility to get a one-time restoration of your complete VA entitlement for the purpose of purchasing another VA loan.

-

Scenario #2 - When the first home is not yet paid off

➙ If your home is still under mortgage and if you intend to retain it forever, temporarily or while you’re considering a sale, it is possible to convert the first home backed by a VA loan into a second loan.

➙ Keep in mind that you have to qualify to meet the qualification criteria for both properties. However, if you plan to keep the first property, you need to know that your eligibility for buying a second home with a VA loan might be impacted.

-

Scenario #3 - If you consider selling your first home

➙ When you’re planning to sell your primary residence, it is important to note that a VA loan is transferable.

➙ This means that the individual who is interested in buying your home can take over the existing loan terms and continue their payments without the need to pay off the loan.

➙ But, if you plan to sell it to someone who is not a VA eligible under an assumption, you will lose your VA entitlement as it is still tied to the old house.

➙ On the contrary, if you sell it to a VA-eligible person, their entitlement is substituted for yours and then you can use another VA loan for a second home with a full VA entitlement.

How does VA entitlement impact your loan?

If you’re curious to know what a VA entitlement means, here’s your answer.

It is the amount paid by the VA to the lender of the VA loan in the event of a loan default so that the mortgage lender can compensate the investors.

There are two types of entitlement that every VA must be aware of, they are basic and bonus entitlement.

-

Basic entitlement

Every veteran is eligible and entitled to a basic entitlement of $36,000. This will be specified on the certificate of eligibility as a whole entitlement.

-

Bonus entitlement

The above entitlement of $36000 is solely based on the average price of the home amounting to $144,000. But, that is not the case anymore in the current real estate market. So, your bonus entitlement will cover 25% of the purchase price above $144,000.

Is it possible to use a VA loan to buy a vacation home?

-

You can buy a VA loan for a second home if you plan to live in your vacation home for the majority of the year or rather for six months or to live there upon retirement within the same year of purchasing it.

-

Otherwise, you can only use a VA loan for a primary residence and not for the purchase of a vacation home.

-

However, if you’re willing to do a makeshift, the old residence can be used as a vacation home, and the new home as your primary residence. Here you need to keep up with both mortgages.

Can you use a VA loan to buy an investment property?

-

Yes, only if you’re willing to use your current home as a rental property while you use a new VA loan to purchase a primary residence. But you can’t buy a property with the sole purpose of turning it into a rental home.

-

If your plans change and you want to convert the property into an investment opportunity, we recommend communicating the same with your lender.

-

The other way to go about this purchase is to buy a multi-unit property where you live in one unit and rent the rest of the units. This way you need not have a rental property but you get to generate rental income. This aligns with the standard VA transaction.

VA loans in the Lone Star State

The state of Texas is known for its robust real estate market, and VA loans play a significant role in making homeownership accessible for veterans of Texas. We'll explore the essential steps one must go through while purchasing a Texas VA mortgage.

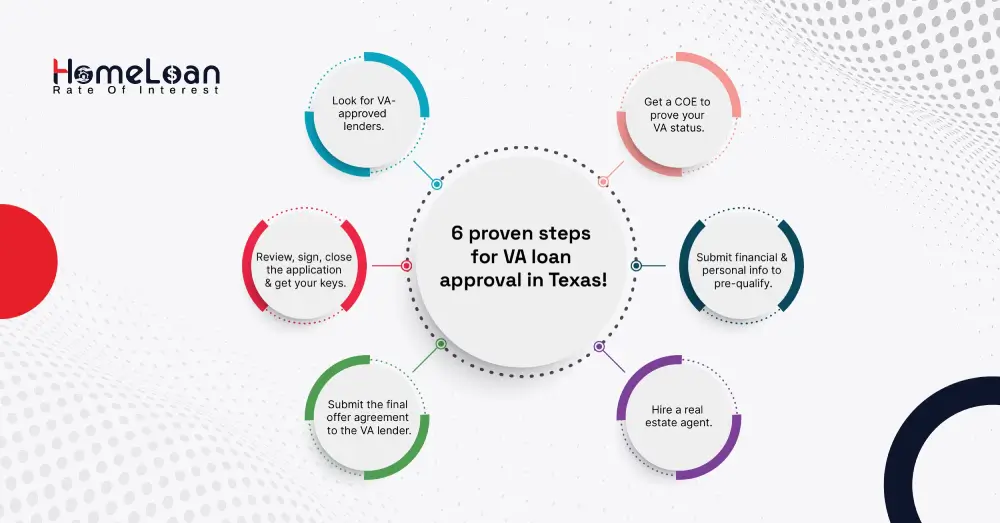

6 simple steps to get VA loans in Texas

-

Select your lender

Choosing a VA-specific lender/Mortgage Loan Specialist is essential as they specialize in working with military members and are approved by the U.S. Department of Veterans Affairs.

The loans are offered by VA-specific lenders who provide specialized loan products that cater to the unique needs of the veterans. This includes lower interest rates and zero down payment.

But, if you’re scratching your head in picking the lender of your choice, reach out to us at Home Loan Rate of Interest to find the perfect financing solution for your second home.

-

Get an eligibility certificate

- Your lender can help you get an eligibility certificate showing that you meet the VA loan requirements. The amount of your eligible VA loan entitlement will be specified in the certificate of eligibility.

-

Pre-qualify for VA loans in Texas

In order to pre-qualify for the best VA loans in Texas, the borrower must approach the lender with all the financial & personal documentation such as their credit history, employment status, marital status, income proof, address of current residence, and more.

The pre-qualification helps borrowers understand the total amount of monthly mortgage payments they can afford.

Click here to check if you meet all the VA loan requirements.

It helps expedite their house-hunting process by providing them with a price range and an opportunity to narrow down and filter the houses.

-

Start looking for houses

Texas, with its diverse cities and landscapes, presents unique opportunities and challenges during the home searching process. For this reason, home buyers can hire a real estate agent.

They will help the homebuyers throughout the application process of purchasing a VA loan for a second home. Once an offer is made on the home, the borrower will receive the purchase agreement stating the price and terms of sale.

-

Submit the purchase agreement to the VA lender

Right after the VA lender receives all the necessary documentation, a VA-certified appraiser will complete the appraisal process ensuring that the home meets all the Texas VA mortgage standards.

They also check if your home’s purchase price aligns with the present market value of similar properties in the county.

-

Close your VA loan application

After appraisal, the lender will share the status of loan approval with the borrower. Upon successful approval, the borrower must carefully review all the mortgage terms and interest rates.

Upon mutual acceptance of the loan terms, if necessary will pay any closing fee if required and also provide proof of homeowner’s insurance.

Once everything is agreed upon with the consent of the borrower, veterans are free to move into their new dream homes.

What’s gonna be your choice?

Veterans of Texas have a great opportunity to strategically leverage their VA loan benefits to achieve their homeownership goals.

The flexibility and advantages provided by VA loans, such as low interest rates and the absence of down payment requirements, make them a powerful financing option for veterans who are seeking to expand their real estate portfolio.

However, the goal of getting a VA loan for a second home can differ for every veteran due to their primary residence status and financial situation. So, make sure to consult with your lender before making big choices.

Make use of the 3 scenarios we have discussed in the introduction part of the blog to understand where you fit in. For more useful insights, do not forget to visit our blogs.